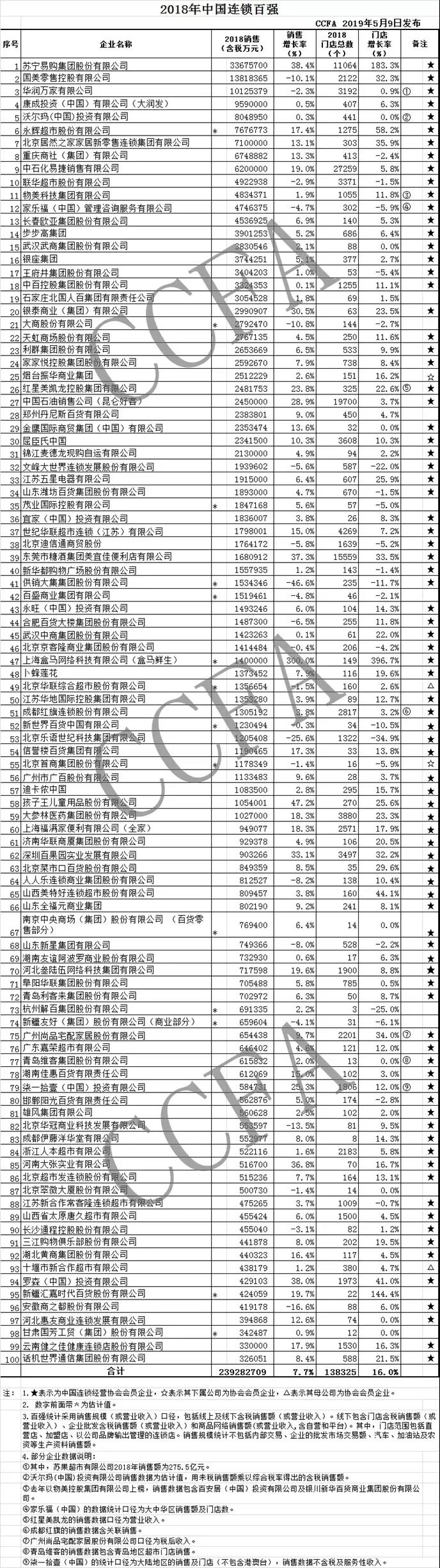

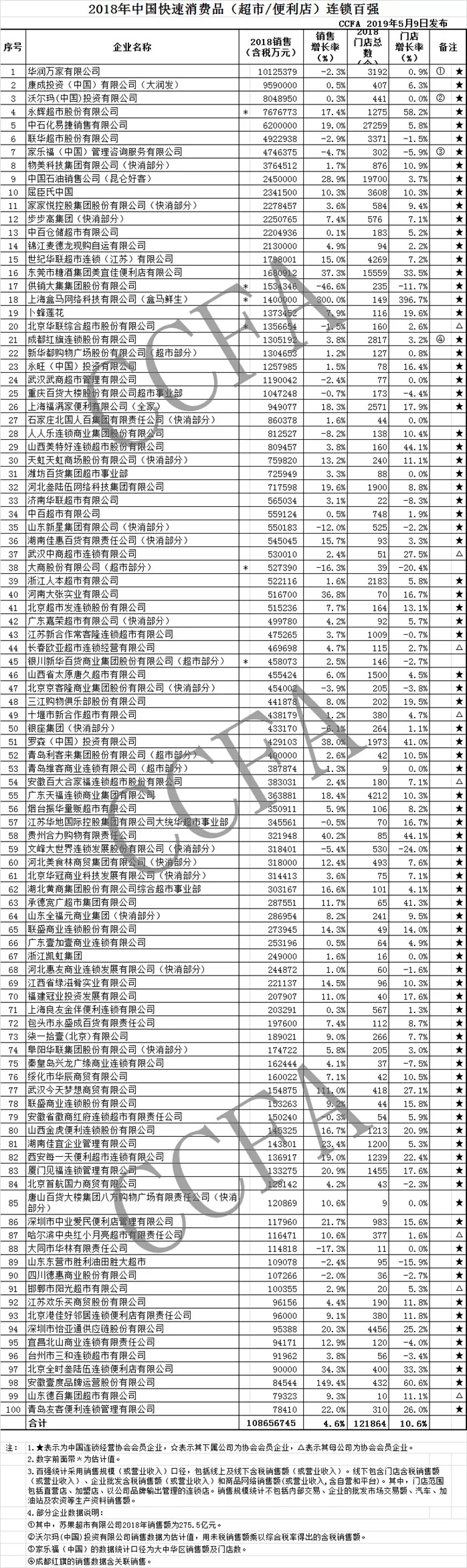

The China Chain Store & Franchise Association "2018 Industry Basic Situation and Chain Top 100 Survey" recently ended, and the "2018 China Chain Top 100" list was released on May 9, 2019.

First, the basic situation

In 2018, the sales volume of the chain top 100 was 2.4 trillion yuan, a year-on-year increase of 7.7%, accounting for 6.3% of the total retail sales of consumer goods, an increase of 0.3 percentage points over the previous year. The total number of chain stores was 138,000, an increase of 16.0% year-on-year. The convenience store outlet factor (including Suning store) was removed, and the growth rate of the top 100 stores was 9.1%, which was the same as the previous year.

In 2018, Suning, Yonghui, Real Home, Yintai, Hongxing Meikailong, Watsons, Meiyijia, Boxma Fresh, Credit House, Children's King, Dashenlin, the whole family, Baiguoyuan, 7-11, Dazhang, 18 companies, including Rosen, Huijia and Jianzhijia, achieved double-digit growth in sales and stores. At the same time, the sales and/or the number of stores of 30 companies showed different degrees of decline compared with the previous year.

Part of the growth in the chain's top 100 sales was due to the positive expansion of omni-channel business. In 2018, the top 100 online sales business grew by 55.5%, which was more than double the growth of online retail sales nationwide. Supermarkets, CP Lotus, Wuxing Electric, Yonghui, Meiyijia, Baiguoyuan, Sinopec and other companies have achieved triple-digit growth. Excluding those with high online sales such as Suning, Gome, and Box Mashengsheng, the top 100 online sales accounted for an average of 2.6%, an increase of 0.8 percentage points over the previous year, of which the supermarket format accounted for 1.9%. The annual increase is 0.6 percentage points.

While developing online business, the top 100 enterprises have further improved their operational efficiency through management optimization. In 2018, the average human effect of the top 100 enterprises was 1.98 million yuan, an increase of 3.0% over the previous year. The average gross profit margin of the top 100 increased from 17.9% in the previous year to 18.3%, with a median of 18.1%, which was the same as the previous year.

Second, regional leaders are mixed, and the low-line market is developing steadily.

The regional leading enterprises in the top 100 enterprises include two types: provincial leading enterprises based on the first- or second-line or provincial capital city layout markets; and leading enterprises in the prefectures and counties that are based on the local (county) layout. Regional leaders tend to develop in multiple formats and have a high market share and leadership position in the local market.

In 2018, the sales and store growth of provincial leading enterprises were 4.2% and 5.5% respectively, and the sales and store growth of leading enterprises in the prefectures were 4.9% and -0.7%, respectively, both lower than the average increase of the top 100.

From the operational situation, the provincial leading enterprises fell by 5.6%, and the human efficiency dropped by 3.4%. The gross profit margin was 19.2%, a slight decrease from the previous year. The operation status of the leading enterprises in the prefectures and counties is obviously better than that of the provincial leading enterprises. The effect of Pingqi and human effect is good in both directions, which is increased by 2.2% and 7.5% respectively. The gross profit margin was 15.2%, an increase of 0.3 percentage points over the previous year.

The leading enterprises in the provinces mostly have the background of state-owned assets. The main business forms are mostly department stores. In recent years, there are competitions between foreign and cross-regional retailers, and the distribution of retail on the wire. In the process of market transition to low-speed development, mechanism innovation and The restructuring of the industry is more urgent.

The leading enterprises in the prefectures and counties have flexible mechanisms and are suitable for consumption. The online and offline competition is not fierce, but the market is relatively small, the consumption population and purchasing power are limited, and some enterprises with good management foundation and strong strength are exploring extensional expansion.

Third, the growth of large supermarkets is weakening, and international brand innovation is changing

As the main format of fast-moving consumer goods retail, large supermarkets generally face the dilemma of declining efficiency and weakening profitability, and the growth is weak.

In 2018, the top 100 companies operating mainly in large supermarkets saw an average increase of 2.5% in sales and an average increase of 3.6% in stores, both of which were significantly lower than the average growth rate of the top 100. At the same time, the operating costs of large supermarkets continued to rise, total employee compensation rose by 13.0%, rents rose by 10.6%, and costs accounted for a higher proportion of sales in all formats.

In 2018, the average efficiency of large supermarkets fell by 8.0%, but the human efficiency increased by 4.9%, and the gross profit margin increased by 0.5 percentage points to 21.5%. Through management optimization, reduction of staff and efficiency, large supermarkets are seeking to grow against the trend.

The international retail brands in the top 100 are mainly large supermarkets. According to some international brand statistics, in 2018, the average efficiency of foreign large-scale supermarkets decreased by 4.0%, the human efficiency increased by 5.5%, and the gross profit margin reached 23.2%, which was better than the average level of 100 powerful supermarkets.

International retail brands have spared no effort in introducing omni-channel retail. In 2018, the online retail sales of the top 100 foreign brands increased by 61.4%, 5.9 percentage points higher than the average of the top 100. Wal-Mart will expand JD.com to more than 250 stores, and its online sales will increase five times over the same day last year. Carrefour cooperates with Tencent to develop online business; AEON sets up retail digital R&D institutions in China; Ito Yokado is on the line of Ito Mall; IKEA and WeChat have jointly launched “IKEA Home Flash Shop”, with online business covering 149 cities; Gaoxin Retail has introduced Ali Amoy Project, with online orders totaling more than 45 million orders.

In terms of capital cooperation, international retail brands also showed a positive attitude. Gao Xin introduced Alibaba, Carrefour introduced Tencent, and Metro launched a plan to attract investment. Yonghui purchased Baijia and Liqun acquired Lotte. In the past two years, it has been the most active stage of capital cooperation between foreign retail enterprises and local enterprises.

Fourth, the department store is difficult to break, the convenience store is triumphant

Among the top 100 companies whose sales and stores declined in 2018, half of the companies that focus on department stores are the main business. In 2018, the total sales of the top 100 department stores increased by 3.5% year-on-year, the number of stores increased by 3.9%, and the online sales increased by 46.1%, all lower than the average of the top 100. Gross profit margin was 17.4%, down 0.2 percentage points from the previous year. Although the overall performance is flat, some department store companies still show a good momentum of development. Taking the credit building as an example, in 2018, the company's sales and stores increased by 17.3% and 13.8% respectively, setting a benchmark for department stores that are based on the market below the third and fourth lines and taking out buyouts.

In the chain of the top 100 various formats, the convenience store growth rate is far ahead. In 2018, the sales volume of the top 100 convenience stores increased by 21.1% year-on-year, the number of stores increased by 18.0%, and 11944 new stores were added, accounting for 62.5% of the total number of new stores.

Joining is the main way to expand and expand convenience store stores. In 2018, the number of franchised stores in the top 100 new stores accounted for more than two-thirds. The average return on investment for franchisees was 23.3 months, slightly shorter than the previous year. Mobile internet technology provides an effective tool for the day-to-day management of convenience stores. In 2018, store management and employee management tools on the mobile side are being widely used.